Maison Law helps anyone that’s been injured in a car accident in California. When you’re in a car accident as an undocumented immigrant, it adds even more stress to your life. Understanding your rights and navigating the insurance process can be complicated, but our team of California car accident lawyers is here to help. Contact us today for a free consultation.

When Should You Hire a Lawyer?

Laws like Assembly Bill 60 give undocumented immigrants the ability to apply for and obtain a special driver’s license. And even more crucially, being an undocumented immigrant doesn’t impact your rights after a car accident in California. This means that, even if you’re undocumented, you can still file an insurance claim or a personal injury lawsuit to take care of medical bills and other losses.

Whether you need a lawyer depends on your situation. If the accident is minor and your injuries are small, you may be able to handle the claim yourself. But if you’re seriously hurt or struggling with the insurance company, legal help can make a big difference.

Our team can:

- Deal with the insurance company for you

- Investigate the accident and gather evidence

- Organize your medical records and expenses

- Coordinate with doctors and medical experts

- Negotiate to reduce medical debt

- Handle settlement talks with the insurance company

- Represent you in court if needed

We aim to make the process easier and help you get a fair settlement. You don’t pay anything upfront–we take our fee from whatever result we get for you.

Is Car Insurance Required in California?

Car insurance isn’t just practical, it’s actually legally required for every driver in California. Specifically, every person in California, regardless of their immigration status or other situations, needs a car insurance policy with the following minimum coverage:

- $30,000 for injuries or death per person

- $60,000 for total injuries or deaths per accident

- $15,000 for property damage

While the vast majority of these policies are going to be offered by companies like State Farm or Allstate, there’s actually a few different kinds of policies that are legally acceptable in the state:

- $75,000 cash deposit with the DMV

- Self-insurance certificate from the DMV

- $75,000 surety bond from a licensed company in California

Again, just because these requirements are in place doesn’t mean everyone follows them. The reality is that car insurance can be costly–but if there’s an accident and there’s no insurance in place, it makes things even costlier. That’s why it’s important to be prepared and understand what kinds of claims you can make if you’re in an accident.

What Kinds of Insurance Claims Happen After a Car Accident?

When there’s a car accident, an insurance company is going to get involved in one way or another. This is true whether it’s your own insurance company or the other person’s. Generally, though, there’s three different types of insurance claims after a typical car accident in California:

- Liability claim – This is the typical process, and happens when you file a claim with your own car insurance company or the other person’s. The purpose of this claim is to recover financial support for your losses, especially relating to your injuries and damage to your car.

- Uninsured motorist (UM) claim – If you’re in an accident caused by a driver who doesn’t have insurance, you can file an uninsured motorist (UM) claim through your own car insurance policy–assuming you have this coverage. It helps pay for your medical bills, lost wages, and other damages that the at-fault driver would have been responsible for.

- Underinsured motorist (UIM) claim – An underinsured motorist (UIM) claim comes into play when the at-fault driver has insurance, but their policy limits aren’t high enough to cover all of your damages. In this situation, your own UIM coverage can help bridge the gap between what the at-fault driver’s policy pays and your actual losses—up to your policy limits.

The most important thing for you to know is that you have a right to take these steps even if you’re an undocumented immigrant. That said, that doesn’t mean that it won’t be difficult.

Why is the Insurance Process So Difficult After a Car Accident?

Obviously, the reason that the insurance process is difficult after a car accident is because the insurance company is effectively working against you. This isn’t necessarily meant to be combative, but their goal and your goal are totally opposite. You expect to get certain payment for what’s happened to you and they’re just trying to save as much money as possible. What this means is that the insurance company usually offers you a lot less in the hopes that you’ll just accept the money and move on.

But understanding what they do specifically can help prepare you and more fully go after what you’re owed. Here’s what they’ll typically try to do:

- Delay – Insurance companies may stall your claim by asking for excessive paperwork, saying forms are incomplete, or making a low initial offer to drag out the process. For undocumented immigrants, they might use fears about your immigration status to pressure you–although this is illegal and you don’t have to accept this treatment.

- Deny – If delaying doesn’t work, they might reject your claim entirely. They could argue you didn’t report the accident in time, didn’t get medical care soon enough, or twist policy details to confuse you.

- Defend – If you need to take further action, it usually means filing a lawsuit. Insurance companies will use their resources to fight back and defend against your claim. Lawsuits can take time and money, but California law gives all accident victims–including undocumented immigrants–the right to seek fair damages.

Knowing these tactics helps you stand up to unfair treatment. But it’s also helpful to look at the statistics behind car accidents in California and what they could mean for you and your family.

How Common are Car Accidents in California?

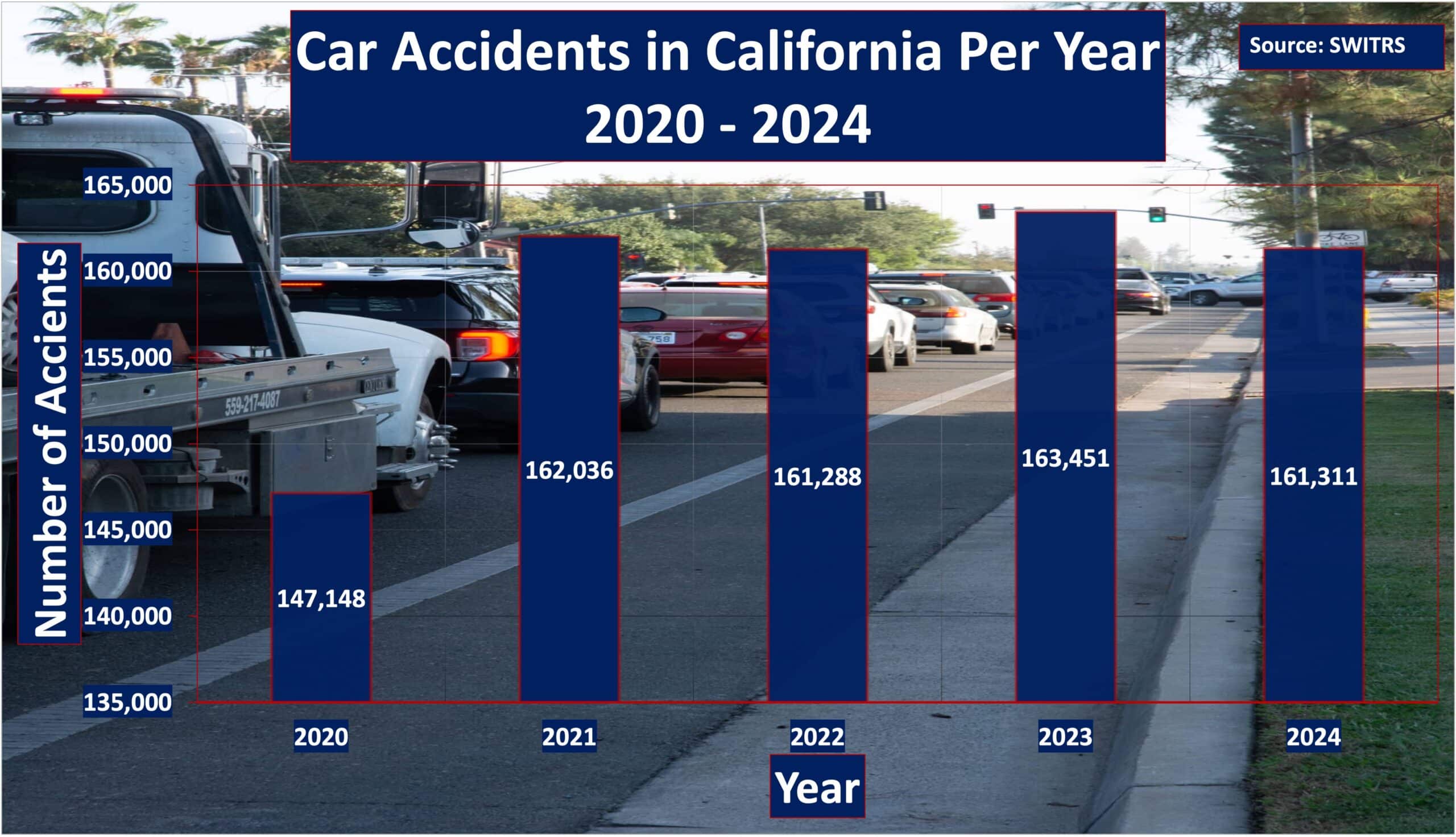

When you look at data from the California Highway Patrol’s Statewide Integrated Traffic Records System (SWITRS), it shows just how common car accidents are. Over the last five years, there has been an average of:

- 159,046 car accidents per year statewide.

When you break that down per year, you can really see how common car accidents have been throughout the state:

- 2020 – 147,148

- 2021 – 162,036

- 2022 – 161,288

- 2023 – 163,451

- 2024 – 161,311

As the data shows, car accidents are an unfortunate part of living and working in California. Whether you’re undocumented or not, it doesn’t really change the likelihood that you could be involved in one of these accidents and have to deal with the aftermath.

What Do You Need to Do After a Car Accident as an Undocumented Immigrant?

Even as an undocumented immigrant, you have the right to file an insurance claim when you’re in a car accident in California. However, the strength of your case depends on how you respond after the accident. Here’s what you should do:

- Call 911 – Check for injuries and call 911 if you or someone else you’re with is hurt. When EMTs get there, let them treat you and also make sure to follow up with a doctor or at urgent care. Some injuries may not show up right away. This will also create an official record of the accident with police, since they should also be alerted and will respond.

- Document the scene yourself – If it’s safe, take photos or videos of the accident, including vehicle damage, visible injuries, skid marks, or the bad road conditions.

- Watch what you say – When speaking to police or insurance companies, be truthful and stick to the facts. Don’t exaggerate or speculate about what happened. You also don’t have to answer questions about your immigration status.

- Exchange Information – Share contact and insurance details with others involved. If you feel uneasy, law enforcement can help you get this information.

Staying calm after an accident can be difficult, but taking the right steps will strengthen your claim and make the insurance process a bit smoother. But again, a car accident can be scary, and not every accident is the same.

Who’s Responsible When There’s a Car Accident?

Car accidents happen every day in California, No matter what type of accident you’re in, the insurance process is going to require you to figure out who’s responsible for causing the accident, and that means showing negligence. There’s four basic parts of negligence:

- The other driver (or another party) had a duty to drive safely.

- They failed to do so.

- Their actions directly caused the accident.

- You suffered injuries and other damages as a result.

In a typical car accident, then, the following can either be fully responsible or at least partially responsible:

- Other drivers – If another driver caused the accident because they were speeding, distracted, or under the influence, they may be responsible for your damages.

- Vehicle owners – If the driver wasn’t the owner of the vehicle, the owner might also be liable.

- Manufacturers – If a car defect played a role, the manufacturer could be at-fault.

- Government agencies – Poor road conditions or missing signs could make the city or state government responsible.

- Employers – If the driver was working at the time, their employer might share the blame.

- Mechanics or repair shops – If bad repairs or maintenance caused the crash, the shop or mechanic could be held responsible.

Even as an undocumented immigrant, you still have the right to file an insurance claim. However, some insurance companies may try to take advantage of your status, hoping you won’t fully go through the process. But you shouldn’t let them try to intimidate you, because what you can get in an insurance claim is going to be very important to your overall recovery when you’re in an accident.

What Kinds of Car Accidents Could You Be Involved In?

With California’s busy roads, car accidents happen every day. Understanding the different types of accidents you might be involved in can help you know what to expect when dealing with insurance companies and give you a clearer picture of who might be responsible:

- Rear-end accidents – These often happen in stop-and-go traffic when a driver follows too closely or is distracted.

- Head-on collisions – These are among the most dangerous kinds of accidents, often caused by a driver crossing into oncoming traffic.

- T-bone accidents – These are most common at intersections, where one car hits another at a right angle. They also happen when someone is running red lights, failing to yield, or misjudging the right of way.

- Distracted driving accidents – Texting, talking on the phone, or other distractions can cause a driver to miss hazards and crash.

- Speeding accidents – Driving too fast reduces reaction time, making it harder to avoid accidents and increasing the severity of injuries.

- Impaired driving accidents – Alcohol and drugs slow reaction times and affect judgment, leading to preventable crashes.

- Hit-and-run accidents – This happens when there’s an accident and the other driver flees the scene. This might require you to file a claim with your own insurance company if you can’t find the other driver.

- Drowsy driving accidents – Drowsy driving can be as dangerous as drunk driving, leading to slower reaction times or drivers falling asleep at the wheel.

- Construction zone accidents – Roadwork and detours can cause confusion and sudden lane changes, leading to collisions.

Car accidents can cause a range of injuries, from whiplash and broken bones to traumatic brain injuries and spinal cord damage. Even minor crashes can leave lasting physical and emotional effects that make the insurance process a necessary step for getting better.

What Can You Get in an Insurance Claim After a Car Accident?

While it’s often frustrating, going through an insurance claim after a car accident has certain benefits, especially if you’re an undocumented immigrant. Either your insurance company or the at-fault party’s insurance company is going to be the one that handles your claim. After you file, an adjuster will review your case and decide how much they think it’s worth.

Specifically though, there’s a few benefits available with an insurance claim:

- Faster payment – You get a payout sooner without waiting for a long court process.

- Lower costs – Going through insurance saves you money because there’s no court costs.

- Less stress – The insurance process is much less formal, and you don’t have to go through a trial–where your immigration status might legally be used against you.

Better yet, insurance makes it easier to know how much you’re getting in “damages,” which can include things like:

- Medical expenses – This covers doctor visits, hospital stays, surgery, medication, physical therapy, and any other treatments you need because of the accident.

- Repair/replacement costs – This covers costs for repairing (or totally replacing) your car and other damaged property.

- Lost income – If your injuries keep you from working, you can get money for the income you lost. If you can’t work the same job in the future, you may also get money for lost earning potential.

- Pain and suffering – This covers costs for the physical pain you’ve endured because of the accident.

- Emotional distress – Similarly, this covers costs related to any anxiety, depression, PTSD, and other emotional struggles.

- Reduced quality of life – If your injuries prevent you from doing activities you once loved, like hobbies, sports, or spending time with family, you may be able to get payment for this reduced quality of life.

- Wrongful death expenses – If your car accident results in fatal injuries, your family may be able to recover funeral costs, lost financial support, and other damages related to this loss.

If you’ve been in an accident in California, you have two years to file a claim. This deadline, called the statute of limitations, starts on the date of the accident. If you miss it, you lose your chance to get a payout. It’s important to act fast so you don’t run out of time.

Frequently Asked Questions

Will my immigration status be used against me?

No. California law protects you and any other undocumented immigrant. The other driver’s insurance company can’t use your immigration status against you to deny or reduce your claim, although they might still try to.

How long do I have to file a claim after my car accident?

You have two years from the accident date to file an insurance claim. If you miss this deadline, you may lose your right to file a claim at all.

Will I have to talk to the other driver’s insurance company?

It’s best to not make detailed statements to the other driver’s insurance reps. They’re trained to get you to make statements that could hurt your claim. If you do talk to them, just stick to the facts, and let our team or your own insurance company handle negotiations.

Will my car accident impact my immigration status?

No. Filing an insurance claim in California will not impact your immigration status. California law protects your right to this claim, regardless of whether you’re undocumented or not.

Put Your Trust in Maison Law After a California Car Accident

As an immigrant, you’re working hard to build a better life for yourself and your family. Whether you’re undocumented or a legal resident, California law protects your rights if you’re injured in a car accident.

When this happens to you, you can rely on Maison Law for help. Our experienced team of California car accident lawyers to guide you through the process and help you get the financial support you need to get better. Contact us today for a free consultation to learn about your legal options.